Bitcoin is a mouth hungry for fossil fuels

This is an awful idea, but I’m writing about bloody Bitcoin again. I recently published a long thread about it, in which I tried to debunk the claim that the process of generating new bits of this digital currency is environmentally beneficial (it is not).

The responses to my thread were exhausting. Some used tortured logic to plead that Bitcoin is beneficial for the environment. Others informed me that climate science is a scam. Some Bitcoin people told me that climate advocates have a knee-jerk, alienating attitude, and others told me to have fun staying poor.

There’s plenty of work so far that’s been done on why Bitcoin is so environmentally damaging. But this experience made me think about a related question: Why is it so damaging? Is it purely technical, or is there more to it?

I think the story of Bitcoin isn’t a sideshow to climate; it’s actually a very significant and central force that will play a major role in dragging down the accelerating pace of positive change. This is because it has an energy consumption problem, it has a fossil fuel industry problem, and it has a deep cultural / ideological problem.

All three, in symbiotic concert, position Bitcoin to stamp out the hard-fought wins of the past two decades, in climate. Years of blood, sweat and tears – in activism, in technological development, in policy and regulation – extinguished by a bunch of bros with laser-eye profile pictures. I’m worried, and I want to explain why.

Bitcoin consumes a lot and doesn’t give much back

To get a bitcoin, you need a computer frantically spitting out random numbers. The more numbers you spit out, the greater the chances of stumbling upon the secret lucky number. Computers doing this consume a lot of electricity – it’s an enormous quantity of work you need to prove you did to get awarded the coin thing. It’s called ‘proof of work’.

This isn’t accidental – it’s by design. “The logic is essentially: if it’s stupendously compute-heavy and difficult to write to the blockchain, then it can’t be done frequently enough to pose a security threat”, wrote computational artist Memo Atken, in a piece that critiques another use of this method, ‘Cryptoart’ tokens to assign ownership to artistic works.

“Endless arrays of computers are sitting around in giant data-centre like mining farms around the world, doing nothing but generating random numbers all day every day, in the hopes of rewarding their owners”, writes Atken.

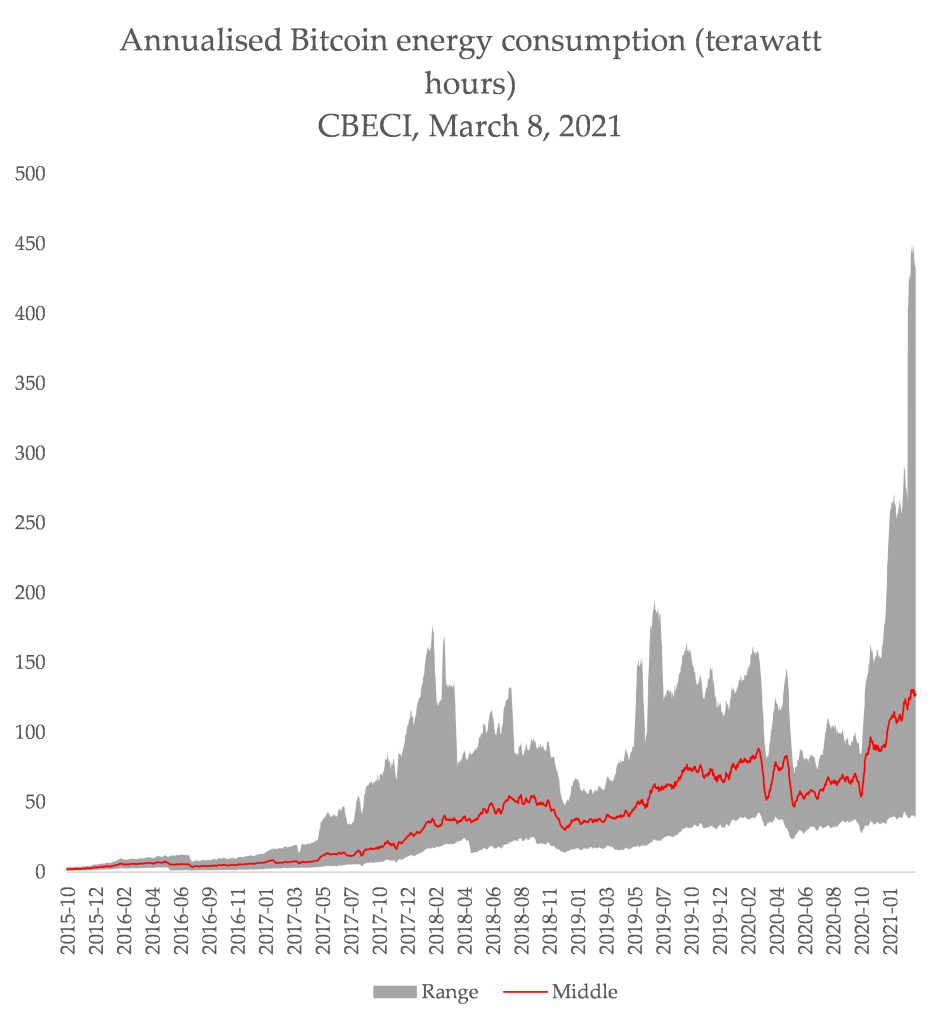

It isn’t easy to figure out exactly how much electrical energy these ‘idling cars’ are consuming, but even the lowest estimates are eye-wateringly bad. Cambridge University seems to have done the most legwork in figuring this out, and at the moment, the annualised power consumption of bitcoin mining is 128 terawatt hours. In 2019-20, every single thing plugged into Australia’s largest main grid consumed 192.

A new commentary published in Joule by Alex de Vries, founder of the Digiconomist blog focused on exposing the externalities of Bitcoin, highlights that this power consumption is linked closely to price. “The record-breaking surge in Bitcoin price at the start of 2021 could result in the network consuming as much energy as all data centres globally, with an associated carbon footprint matching London’s footprint size”, writes de Vries. There’s a related point worth mentioning too – Bitcoin mining consumes physical hardware, meaning these farms are burning through computer chips that could otherwise be used for working-from-home applications (we need this to fly less) or electric vehicles.

“WHO WENT AND MADE YOU THE ENERGY POLICE???” is a common rebuttal (alternatively, there’s “once comprehended, you’ll see that Bitcoin must necessarily consume most of the world’s energy”, but let’s just leave that one alone for now).

The implication with much of the focus on Bitcoin’s energy consumption is simply that it isn’t worth it. It is hard to disagree, unless you are literally invested in it. There is absolutely no other industry that consumes this much power while only giving back to society sea-lioning men on Twitter.

“How often do you hear about the societal merit of game consoles, clothes dryers or Christmas lights?”, pleads Coindesk’s Nic Carter. The Christmas lights thing seems to come from a 2017 analysis, which claims Bitcoin’s consumption is lower than annual yearly US Christmas light power consumption. But that analysis uses 2007 data, for Christmas lights, prior to the dominance of LED lighting, and a 2017 lower bound estimate of Bitcoin power consumption, now at least 3 or 4 times larger.

Importantly, the numbers are besides the point. The reason you don’t (often) hear outrage about Christmas light power consumption is because there isn’t a litany of instances of Christmas lights users being run out of town for consuming so much electrical power it destabilises the grid and threatens supply to households and industry. Like Bitcoin miners in Eastern Washington, Upstate New York, Iran, and most recently, the region of Inner Mongolia, in China. Around 8% of the world’s Bitcoin mining is based in that region, and they’ve got until April to leave. The energy Christmas lights do use is accepted by society as proportionate to what we get from them (heaps of cheer and good vibes). Ditto for gaming. What do you think the results would be, if you asked 100,000 random global citizens if they used any streaming video service, and if they used Bitcoin?

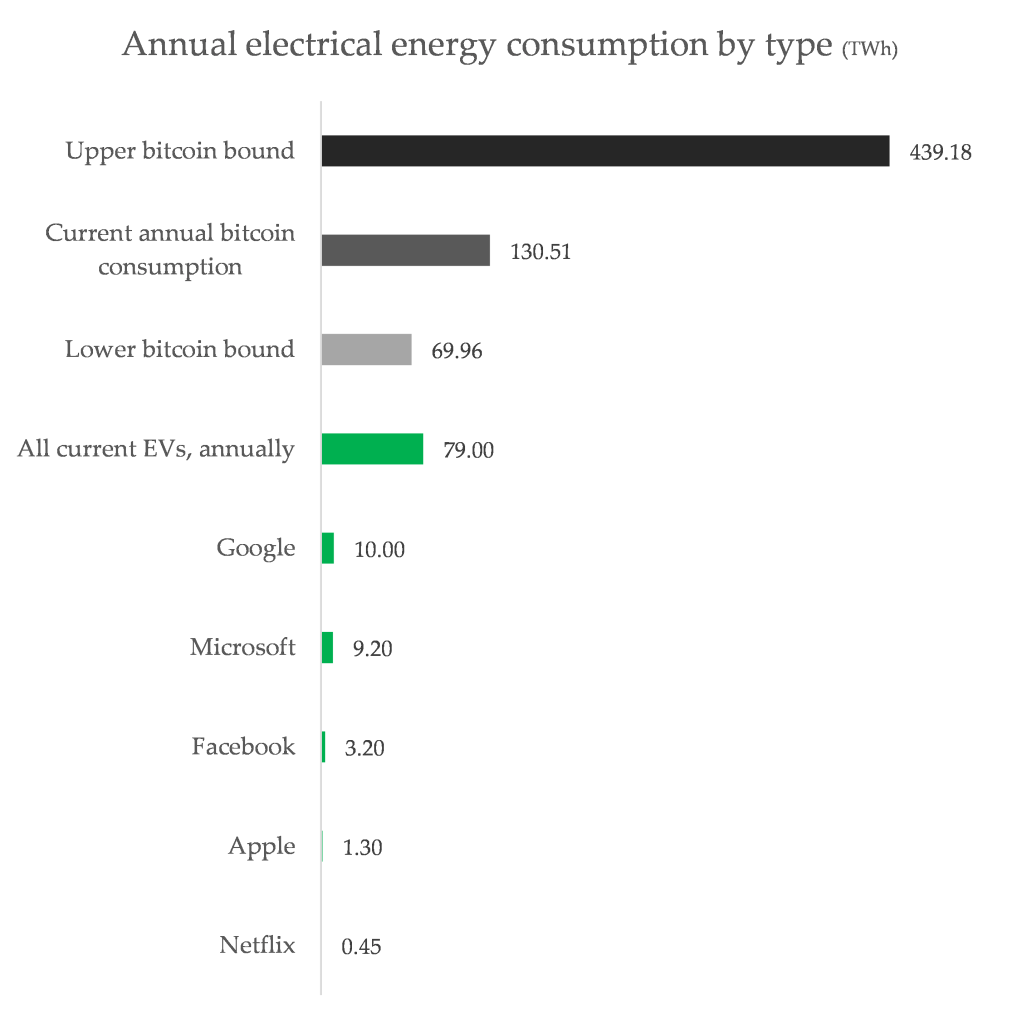

Bitcoin mining’s energy consumption eclipses that of major global tech companies providing entertainment and services, looking at annual electrical energy consumption values from various reports:

Of course, many of the services above have been attacked as being environmentally damaging, because they’re ‘consuming too much energy’. But the imbalance is inverse. Media outlets shaming millennials for sending too many emails or watching too much Netflix (“Hah, what hypocrites!”) are consistently using dodgy math exaggerating energy consumption. Not only are these services also subject to the ‘energy morality police’, it’s even worse, in that their impact is overestimated, not underestimated. Despite the reproachful moaning, Bitcoin absolutely earns the aggressive scrutiny it gets. It probably deserves more.

Of course, electric gluttony matters because the majority of the world’s power is generated using fossil fuels, and doing so creates humanity-wrecking greenhouse gas emissions. Unlike companies like Google, which transparently purchase zero emissions power, Bitcoin’s climate impact can only be guesstimated using a complex methodology. Cambridge University suggests Bitcoin energy is around 29%-39% zero emissions (mostly hydro); the rest is pure fossil (advocates claim 76%, but that refers not to energy but the proportion of Bitcoin miners with at least some non-zero amount of renewables; a dodgy piece of wordplay).

Electricity is the lowest hanging fruit of decarbonisation, wind and solar are getting cheaper every day and things are changing fast. If the power sector gets decarbonised, Bitcoin mining becomes climate neutral by default, right?

Not quite. That long path to a global zero emissions grid is going to be really long, and the shallower the decline of fossil fuels, the more total greenhouse gas emissions are added to the atmosphere.

It matters, then, that there seems to be a massive sector of the Bitcoin community that actively seeks out fossil fuels to burn, making that decline even shallower, and resulting in increased emissions and climate harm.

The pro-fossil instincts of the Bitcoin mining industry

In a viral thread, Yassine Elmandjra, an analyst at ARK Invest (and possibly the only Bitcoin man without a laser-eyes profile picture) details his justifications for claiming “the impact of bitcoin mining is a net positive for the environment”. As he says, it is “contrary to consensus thinking” (a plea climate scientists might find a little familiar). It isn’t a rare view in their community, either.

He says the computers that hungrily consume electrical power to generate enough random numbers to earn Bitcoin can be powered by-products from fossil gas mining fields in the United States.

During that process, gases and liquids can build up and have to either be vented into the sky, or burned as a flame. Both venting and flaring from fossil gas mining are major contributors to climate change. It looks like this:

Elmandjra has a solution: simply take that vented or burned gas, and burn it to create electricity for bitcoin mining! The man cited in the thread to claim that burning “waste” fossil fuels to mine bitcoin, Marty Bent, seems to work to facilitate partnerships between bitcoin miners and oil and gas companies. On his blog, he writes:

“From an optics perspective, we believe this trend provides the oil and gas industry with the best opportunity to turn the tides in their favour, specifically regarding how the public views their stewardship of the environment”

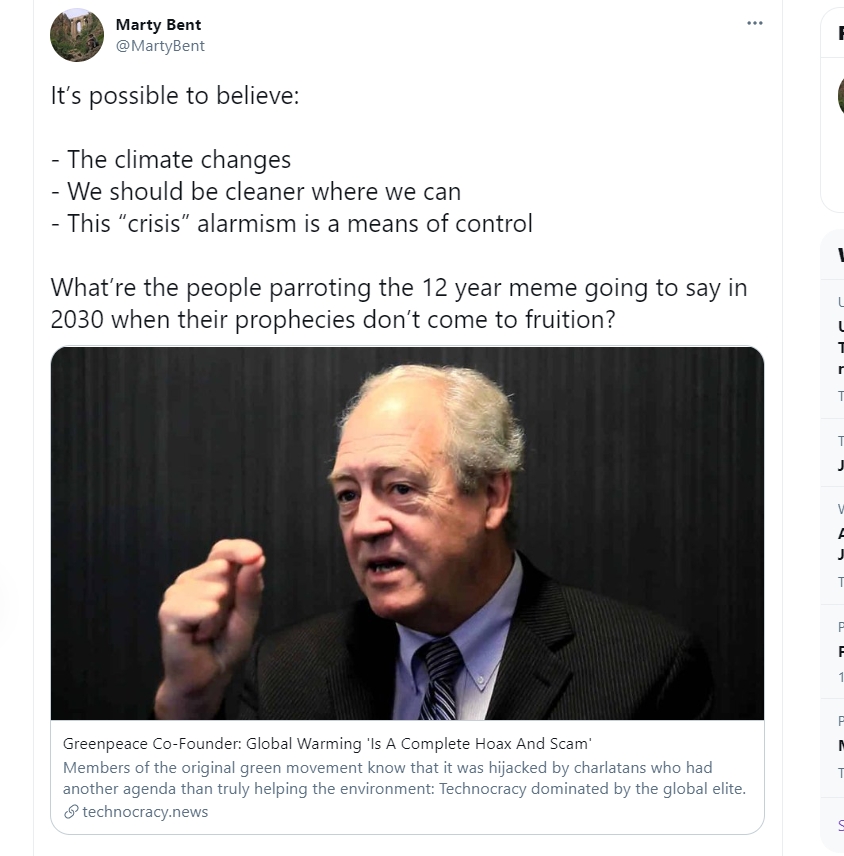

His site even comes with a handy tool to calculate how much money you could earn from bitcoin mining relative to the quantity of fossil fuels you extract and sell. Bent does not seem particularly convinced by the science indicating that fossil fuels release greenhouse gases and create the threat of climate change.

Of course, the problem of climate change does not arise because fossil fuel companies aren’t efficient enough in their on-site processes. It’s because fossil fuels are burned on a massive, global scale. Making these companies more streamlined in their efforts to extract fossil fuels worsens the problem. This should be obvious.

This isn’t a widespread thing, right? It’s not like ‘fossil fuels weekly magazine’ or whatever is widely promoting this activity? Oh wait, a literal magazine named OIL MAN is doing exactly that.

Yes, this is mainstream in the fossil fuel industry. Several global oil and gas giants specifically see using otherwise flared or vented methane to mine bitcoin as a way to profit from what they will market as an environmentally friendly waste reduction tactic. Norway’s Equinor and Russia’s Gazprom are both onboard.

The tweet above, by GigaEnergy’s co-founder Matt Lohstroh has thankfully been receiving some pretty significant attention over the past few days. “This really drives the point home; crypto produces NOTHING, it contributes NOTHING to society”, is one response. “Our world runs on oil, thus natural gas being vented/flared is inevitable”, Lohstroh pleads, in defence of the fossil Bitcoin operation.

Adding revenue streams to fossil companies already raking in ultra-cash from supplying a harmful product isn’t a net good. It’s perfectly analogous to plastic being manufactured from the waste products of oil and gas mining and being monetised for decades. It is now creating its own accelerating environmental devastation, while providing piles of money to fossil majors. Monetising the waste products of fossil fuel extraction elevates the oil and gas industry, rather than accelerating its demise. On top of that, these Bitcoin companies choose to burn fossil fuels. It’s a bi-directional greenwashing symbiosis, and it’s blatantly widespread in the community.

Yassine’s ‘yay, burning gas!’ thread was liked on Twitter by none other than Former Sworn Enemy of the Fossil Fuel Industry Elon Musk. “We need to appeal to the people and educate them to sort of revolt against this and to fight the propaganda of the fossil fuel industry which is unrelenting and enormous”, he said in 2016. By September 2020, Musk was saying “feel a bit bad about hating on the oil and gas industry”. This year, Tesla purchased $1.5 billion USD worth of Bitcoin and SpaceX applied for a permit to extract fossil gas in Texas (they’re currently fighting with mining companies over who gets the fossil fuels).

The Venn circles of Silicon Valley tech folks, libertarians, finance bros and oil and gas bros all seem to meet centrally at whatever the hell Bitcoin is. In world where a lot of people give a shit about protecting our planet, there is a broader effort to plead, through a series of misunderstandings, broken arguments and empty promises, that the act will be cleaned up very soon.

Bitcoin’s great big greenwashing push

This 2019 piece by Maximillian Fiege, who works for Signum Growth Capital, an advisor to ARK, details clearly (and with pretty good knowledge of the energy industry) why bitcoin miners are driven towards fossil fuel operations. Some bitcoin mining operations camp out where power is cheap, plentiful and far too over-supplied, such as China’s massive hydropower schemes, poorly connected to areas of high demand. Of course, they also camp out in coal-rich regions in China. If zero emissions power is used, it’s a side-effect, not an effort to engage in climate action.

Fiege doesn’t make a secret of the fact that this loophole is being erased, because in a climate constrained world, there is no room for wasted potential. The growth of transmission lines and interconnection between regions is accelerating. That means far less ‘surplus’ from renewables. If zero emissions power is “stranded”, it shouldn’t be, because there is still fossil power in the world, and in a climate emergency, it should be displacing fossil fuels, not just meeting new demand.

Despite the natural gravity of this industry leaning towards carbon intensive fuels, there is an instinct to half-heartedly greenwash the climate damage of Bitcoin. This manifests not just through promises to do better in the future, but some genuinely silly arguments that frame Bitcoin as a grid tool that helps wind and solar do their thing.

Recently, Norway’s 3rd biggest oil and gas firm, Aker Solutions, announced it was creating a spin-off named Seetee to hold a massive reserve of Bitcoin, and “establish mining operations that transfer stranded or intermittent electricity without stable demand locally”. Kjell Inge Røkke, one of Norway’s richest men, with a net worth of around $5 billion, wrote in a shareholder letter that “Bitcoin is, in our eyes, a load-balancing economic battery, and batteries are essential to the energy transition required to reach the targets of the Paris Agreement. Our ambition is to be a valuable partner in new renewable projects”. Their partner, Blockstream, promises to use Bitcoin mining to ease wind and solar integration by consuming electricity when there is “surplus” renewables during low demand periods.

Energy storage works in two ways: first, it consumes power, then it generates it. Bitcoin is not energy storage. Bitcoin consumes electrical power, and then seems to only generate a bunch of intense emotions in white guys named Todd in my Twitter mentions. The gap between reality and these claims is so massive. But that gap indicates just how half-hearted the greenwashing element of Bitcoin is. A bunch of words they saw are chewed up and spat out, with near-zero comprehension of the grid dynamics involved.

Bitcoin’s massive demand could serve as a load balancing tool, consuming power only during rare moments of excess wind / solar output, but that again raises the question of why that surplus isn’t being used to charge a battery, produce hydrogen, or be transported via transmission line where it’s needed, all to displace fossil fuels. And of course, as grid design gets better, that amount of ‘surplus’ should rapidly shrink to zero. If it doesn’t, something is wrong.

Perhaps most egregiously, Aker’s partner Blockstream presents their projects as “energy efficiency”. Bitcoin mining is the exact opposite of energy efficiency. By my own calculations, the energy consumption of the network easily wipes out America’s entire energy efficiency efforts. These people hear climate and energy keywords and are now just slapping it on their projects, in the hope that that’ll ward off criticism. Storage? Energy efficiency? Demand response? Yeah, that’s what this is! Why the hell not?

It is also worth asking what incentive a company mostly invested in fossil fuels might have in ensuring that stranded renewable energy stays stranded, and that the supply of new renewable energy gets diverted into powering hyperactive Bitcoin mining rigs, instead of being stored or moved so it displaces fossil fuels. What could it possibly be? No idea.

In fact, diverting renewable energy to simply filling up new demand instead of cutting downwards into fossil fuel output has been a major focus for the fossil fuel industry. America’s gas industry, for instance, has won at ensuring precisely this effect, as the country’s ultra-cheap gas output has risen rapidly:

The fossil fuel industry has had a focus on encouraging a high-energy world for quite some time. They need demand – the bigger, the more outrageous and the faster growing the better. The less competition from cheap renewable energy – preferably chained to random number generators instead of connected into power grids – the better.

For now, the Bitcoin mining industry will do precisely what the fossil fuel industry has been doing for decades now: promise to clean up their act, while aggressively working to make it dirtier.

For the most part, this greenwashing isn’t for us. It’s for those in the community with a guilty conscience and for nervous rich investors and speculators. It ends up so weird and confused because it’s a community of explicitly anti-community, anti-government people clumsily feigning membership on a finite physical planet stocked with other non-Bitcoin people. That’s how you end up with a mix of ‘Bitcoin is a battery’, mixed with ‘STAY POOR CLIMATE ALARMIST SJW’. It is exhausting and unpleasant.

“Bitcoin miners will have strong incentives to align their operations with fossil fuels,” says Fiegein his 2019 post, as fossil fuel assets lose all profitability in renewable-soaked grids and become more “stranded” than remote renewables. There is no such thing as ‘spare’ renewable capacity. Rising demand helps fossil fuels, and falling demand helps renewable energy (the resulting squeeze and cheap renewables mean emissions fall, as we saw in 2020 due to COVID19’s demand crunch).

Fiege details how Bitcoin miners fled the zero emissions hydropower of China to consume oil-heavy Iranian power, over-supplied due to sanctions applied to the country by the US. In recent weeks, those mining operations have contributed to blackouts and grid stress in Iran, and the government is cracking down on the activity. “The prospect of utility independence and wholesale rates make fossil fuels far more compelling than grid-restricted renewables”, he simply declares. Despite the confused, tortured logic trying to mimic the language of climate action, and the vague promises to do better, there is an inherent drive towards fossil fuels.

Bitcoin is presented as beneficial because it puts waste to a good, profitable use. It’s the computery equivalent of burning single-use plastic in incinerators to generate electricity (the source of rising emissions in my home, Oslo). Monetising waste doesn’t decrease inefficiency, it rewards it. And in industries that are harmful, like the fossil fuel industry, it simply makes for a more streamlined dagger.

If Bitcoin mining is consuming ‘stranded’ renewables, it is holding back a more efficient grid and slowing down fossil displacement. If it’s consuming ‘stranded’ fossil fuels, it’s creating greenhouse gas emissions, and causing climate change (which is real, you know). There is no worse time in history for an energy-hungry, low-benefit industry that has a specific thirst for fossil fuels, underneath layers of greenwashing. Tomorrow will be an even worse time, as will the day after.

I guess that eventually, instead of constantly travelling the world hunting for and monetising bad grid design and fossil fuel waste, Bitcoin mining could become like every other energy intensive industry and participate in the complicated social, political and economic process of finding a place in a zero carbon, energy constrained world.

That would mean a cultural change. It would mean acting in good faith, recognising that they’re part of a world in which other people generate and consume energy, and recognising that climate change is real, and requires rapid, collective action. It would mean finding out what ‘storage’ is.

Turns out there’s a reason the Bitcoin community isn’t likely to get on board with this.

It’s because libertarians are very bad at climate action

Never do this, but diving into the culture of the Bitcoin community is insightful. It’s a weird blend of the boyish hyper-emotionality of gamergate, the naïve righteousness of Elon Musk fandom and the unambiguous cruelty of finance bros. You’ll see shared traits, like an open hostility towards centralisation, governments and authorities.

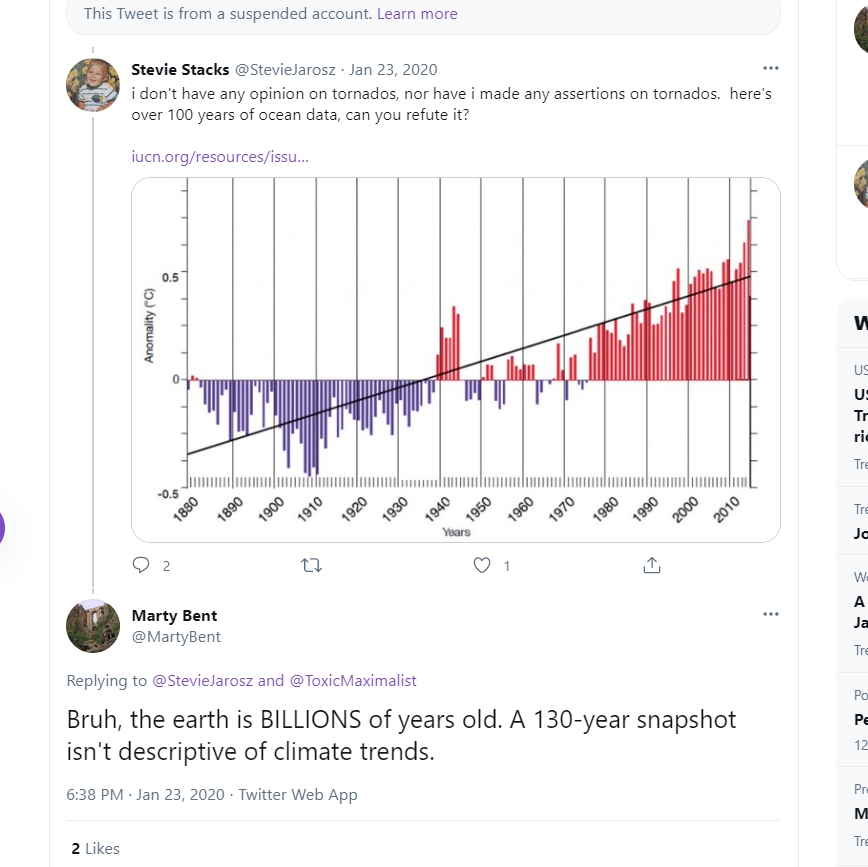

It makes sense, then, that so many of the replies to my original thread invoked bog-standard, decades-old libertarian climate denial.

The climate challenge implies some level of new government regulation and collective action. Individualists played a key role in denying the climate problem, as a reaction to the shape of these solutions. Libertarianism was a key identity marker of climate change deniers.

Renewable energy, often incentivised using the government intervention of subsidies, credits or feed-in tariffs, is a natural enemy of libertarians. Nic Carter, who has featured heavily in Bloomberg’s coverage of environmental impacts of Bitcoin, claims on Twitter that Texas’ blackouts were primarily caused by wind farms, and has also decried “climate alarmism”. Bitcoin company “Great American Mining” shared a screenshot of an article that claims solar farms cause global warming. Another Bitcoin company, Upstream Data, has people that make no secret of this:

Where you find a weirdly aggressive loathing for wind and solar, you’ll probably find an outright denial of climate science too. “The climate Nazis are inferior thinkers, that’s the good news”, says Upstream Data’s Adam O.

Saifedean Ammous, the economist author of the #1 bestseller ‘The Bitcoin Standard’ (who is personally thanked in Aker’s shareholder letter), says stuff like this:

Delightfully, one keen Bitcoin man has even written a jaunty sea shanty about this. It covers a lot of important ground, but the climate verse is telling:

When they say that it’s boiling the oceans and seas

And could power and entire country or three

Or their wailing “How dare you, we’re all gonna die”

You can spew out more carbon dioxide to cry…Have fun staying poor!

There is an obvious cultural thing going on here. The libertarian-leaning Bitcoin community is not equipped to deal with a threat that requires global government intervention, collective action and a calm, level-headed engagement with experts, science and complexity. They react either with confused pleas (“Bitcoin will incentivise renewable energy!”), outright antagonism towards wind and solar, or just old school denialism. They close ranks and simmer in a puddle of outgroup hostility. They search for keywords on Twitter and dogpile doubters.

Awareness of environmental impacts, caring about the consequences of one’s actions, and accepting the science when it implies a threat requiring government action just isn’t in the DNA of hyper-individualistic libertarians. This is why critique of energy consumption is perceived as some sort of authoritarianism – the ‘energy police‘ – because being asked to acknowledge the existence of other people or the planet is offensive and triggers an automatic response.

There seem to be a few companies and people dedicated to actually using zero carbon sources and reducing the energy consumption of Bitcoin. But these exceptions are working against the gravity of their own movement, and there’s little sign of a change in direction. Again, it rhymes perfectly with the fossil fuel industry, within which the few good-faith actors are pushing against a house-sized boulder rolling down a hill into environmental catastrophe.

What hope is there of a climate friendly Bitcoin reformation, where the fraction of zero emissions sources expands to 100%, and mining firms become good faith participants in the socio-technical complexities of electrical grids? What hope is there that these people will pivot to genuine support for collective, top-down action to protect humanity from greenhouse gas emissions and work to forcibly end the deadly fossil fuel industry?

The pro-fossil, anti-climate libertarian worldview is baked in too deep. So, almost none, I think.

Edit 14:00 11/03/2021 CET – Edited wording for Max Fiege’s role to clarify, sorry Max!

Mining is bad for the environment, even when it’s digital. Shocking. I wish I could say “said no one” but apprently people are still surprised.

However, blanket titles don’t really make a convincing argument. Mining is power hungry. Usage, however, depends.

Getting bitcoin doesn’t require mining (on an absolute level speaking), you can get it by purchasing it.

Obviously, mining has come to a point where it’s a most serious issue in terms of impact. Which is quite how the system was meant to work. Mining makes sense until it doesn’t and I would surely hope we’ve come to the point where the activity would be regulated, reduced, taxed and so on.

LikeLike

I want to first state I don’t agree with all things said in this article but I loved it very insightful and I like how it discusses the ambiguousness of some of the case studies and stats used. However a big point that was missed is the physical footprint of Bitcoin compared to that of any traditional techs or banks. The environmental analysis to compare the emissions causes from building physical locations and physical products compared to that of Bitcoin from what I know would really balance the scales in terms of bitcoins favor. For example the one about tech companies energy consumption: (I haven’t checked but someone do) that does not consider the amount on energy used to build all of googles physical infrastructure whether it be offices, campuses, physical products like phones etc. my point is the minimalist reasources used to just set up these mining operations is SOOOO small compared to that of any tech companies or any company that produces any physical products. While the operational energy consumption may be relatively higher and cause more emissions, these other companies and operations cause so much emissions from physical products that bitcoin mining never will

LikeLike

It has been recognized for some time that Bitcoin’s algorithm is overkill, and it has the most extreme example of energy usage. This is why the Bitcoin miners cluster near cheap power. Essentially they are using artificially low electricity prices that do not include an environmental cost. But there are no practical reason miners can’t be charged a premium for their electricity usage. This may force many miners to stop mining bitcoin and go out of business: good. Eventually this leads to the ‘proof of work’ task to get easier (and less energy intensive). As long as there are a minimum viable number of miners (if one pool of miners controls a majority then they can game the ledger) then Bitcoin is no worse off. This is what makes the issue of 128Tw/h even more grotesque… it is only occurring because so many people/companies are mining and so much computing power is being thrown at the problem.

LikeLike

Heyyy here’s more fud…. Looking to drop the price so you can buy in haha ! Enjoy – why don’t you compare the consumption of energy of the entire financial system?… Bore off… Clearly, your a bear… Enjoy being a bear…. Why don’t you hibernate…. I’m looking for red capes…..

LikeLike

Your arguments on excessive energy consumption are mostly sound, I believe. A bit harsh on it not producing anything, i.e. no real value. A value that you perhaps don’t yet see or appreciate perhaps.

Not my original thought – alchemists have for centuries sought the magic formula to create gold and now we can – electricity into digital gold.

In any event, it doesn’t matter, the industry behind Bitcoin is staggering. You may not agree that it’s digital gold but many individuals and corporations do. And soon that will include sovereign entities. Any day now.

It’s reached critical mass. Physical gold had been the standard for centuries but things change, paradigms get overturned. Digital gold’s turn now whether we like it or not.

LikeLike

I would love if an article on Bitcoin or digital currency effects on the climate talked about what impact does it have to the climate vs mining for gold, nickel or copper to make cash. Just curious which is more damaging as no one has ever written an article about that. Bitcoin mining vs Gold, Copper & Nickel Mining what does more damage to our earth.

LikeLiked by 1 person

I’ve spent 15 years in the energy industry with notable placement at top utilities in both renewable and traditional energy. Stop with your FUD.

LikeLiked by 1 person